Big Help for your Future

Planners are Calculators that simplify the process of Budgeting Goals.

Everyone has Income, Savings, and Spending and YBP has various Planning Tools in each of the categories to help ensure your Budgeting attains the best results possible.

All of the following Planners are optional but they are very useful to help plan and create your goals.

Calculators/Planners

Your Budget Plan created a few different Calculators/Planners in order to provide a unique Budgeting Experience. The features will aid in creating a more meaningful successful budget.

Budgeters so often are trying to solve the age-old problems of not saving enough, poor spending, and getting into debt.

Calculators are used to creating better financial plans. They are constructed to be more informational, figure out values, total the values, keep track of funds saved or spent. Many Budgets have calculators but they act singularly. You fill out some information and values, then you have to transfer the info over to the budget. All or most of our Calculators are totally interactive within the budget program. When a calculator is created or info up-dated and saved, all of its information will be updated throughout the Budget Program. There is no need to do any extra work. This will give you better peace of mind.

Savings Calculators

A favourite and specialty of YBP

Many budgets are set up as lists to categorize expenses, then either put in one slot for savings or allow a few minor savings breakdowns. We have created a set of concepts to actually help people save better, spend wiser and pay down bad debt then stay clear of such debt.

Many calculators are very simple. They don’t have much detail so some costs may not be considered.

Some examples of missed costs in many calculators:

- Buying a Property – need to consider repairs, civic tax rebate, legal fees, home inspections, and in some areas mortgage default insurance.

- Home Renovations – might be junk removal costs or unknown surprises like rot

- Home Furnishings – maybe a warrantee is desired

- Traveling – do you need a new passport, need to park the car at the airport, if driving, did you consider fuel costs? Will you need health or travel insurance?

Your Budget Plan calculators include these costs, therefore, creating a higher degree of the true cost.

Available Planner/Calculators

There is one for:

- Travels +++put a screenshot of a travel planner here+++

- Weddings +++put a screenshot of a wedding planner here+++

- Vehicle Purchases +++put a screenshot of a vehicle purchase here+++

- Emergencies (the most important one) +++put a screenshot of an emergency planner here+++

- A basic one that can be customized +++put a screenshot of a basic planner here+++

- A simple Ongoing planner to put funds into for any use at all +++put a screenshot of an Ongoing planner here+++

Future Calculators:

- A series for buying property (mortgage)

- Post-secondary education

- Retirement

- Future Worth

- Assets and Liabilities

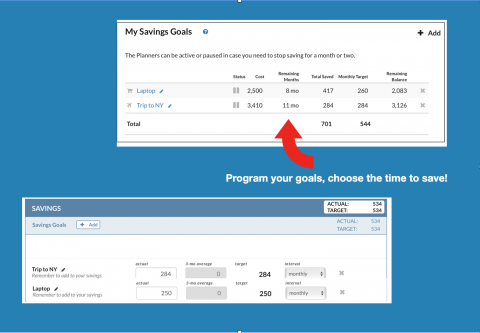

Once adding a Savings Calculator, it will show in the Budget in the Special Savings section. It will show how much your target is and how much you saved (or spent). In the Savings Calculator, it will show you how much has been saved and how many months you need to save.

The Savings section will also add up all of your savings goals so you know how much you’ve saved. It is a good feeling knowing that you are saving up for something.

Debt Repayment Tracker

+++ put a screenshot of a debt repayment planner here +++

YBP has an APP to plan and follow a Debt Repayment Plan. Each month the Budget will show your debt and remind you to make it an important issue in your budget. The program will follow your bad debt as you pay it down and eliminate it.

Bad Debt or Excessive debt is what needs to be worried about. Planned debt like a mortgage or car loan is built into the budget. Missing a loan payment or having credit card debt is bad or excessive debt. This will hamper the budget and penalties are wasted money.

If the planner is created but no funds repaid then a flag will automatically show up to remind that a payment is needed.

Variable Income Adjustor

+++ put screenshot of VIA here +++

Many people have hourly paying jobs and they receive uneven income from month to month. It can be a bit hard to keep track of finances when income is sporadic.

YBP has an app that helps with irregular income. It helps create a more even flow and even helps build up a cash reserve in case of poor income months.