Starting up your Money Plan

There are some questions to ask and things to consider when you begin to get a money management plan underway.

- How much money are you making?

- Who is living on this money: you, your family, ageing parents?

- Who is in charge of the budget, if you live with someone else?

- What are the budget components that each of you will be in charge of and how will you communicate about them to each other?

If you are a couple attempting to manage money together, are you similar or different in your spending habits and mindsets? Are you in agreement on how to spend, save and allocate debt repayment? Since money is one of the greatest topics of conflict for a couple, you should definitely establish agreements about all of these things. Don't worry about filling in all the blanks at the outset though. With the practice of creating and following a budget together, you'll naturally start to see patterns and areas of conflict emerge. The Your Budget Plan system offers a historical spending guide to help you see your average costs, your spending patterns and how these things may be working for or against your life goals. Whether you use YBP or another budgeting system, observing spending patterns and looking carefully at what your costs tend to be against your earnings is the very first part of developing a realistic financial plan.

++++ CTA to BUDGET PLANNER ++++ for Katja

Financial Planning Steps

We've written HERE about using the services of Financial Planners, who usually work with clients on matters such as:

- working on the cash flow (a budget)

- figuring out the net worth of the client's assets

- tax planning

- creating financial goals (long term goals -both small and big-ticket items/events)

- risk management (including investments and insurance)

- retirement savings and spending plan (pre-retirement and during retirement)

- estate planning (wills and other special directives)

Wealthier clients can more easily absorb the costs and the benefits to them usually outweigh the costs. Other people can use some of the features but must watch out for costs.

Lower the Costs.

- Use your bank Financial Planner and the products they promote. This limits the services and investments but the costs are lower.

- Learning to use a budget is reasonably inexpensive or free. Budgets with charges usually have better features.

- Net Worth: If you need a loan, loan officers will help you figure out your net worth.

- Tax planning: can be expensive so it is mainly for the wealthy. The average person won't likely get their cost back.

- Creating financial goals can be DIY. It is a bit difficult but there are calculators on the internet that can help find values.

- Risk management is a tough one. It usually involves investments. If using the banks investment product's the cost is usually built into the investment itself. Mutual funds have upfront and backend costs that may shock, so learn about them. ETFs and stocks can be very costly to buy and sell if using a financial planner or broker. The way around it is to learn to buy and sell yourself via a personal brokerage account.

- Retirement Savings Plans can be somewhat reasonable if using a company like Sunlife or a new Robo-advisor (computer programmed accounts that just buy ETFs and MFs based on a client's desires). Their costs are built into the system but these companies have limited numbers of products.

- Estate Planning is for wealthier people although wills should be done. Wills can be tricky, even if leaving everything to just one person. A will is best left to a notary or lawyer.

Setting Financial Goals

As you begin your savings plan, one thing you can do at the outset is to list your family goals. These are often called 'long-term goals' as they are usually a few months to many years. They are also divided into small-ticket items and big-ticket items (these need to be linked to Financial Goals page). You don't need to start saving for everything all at once, start isolating the most important goals. The small ticket items/events won't require major thinking, they just need to be included in the budget. Big-ticket items, on the other hand, will take longer to save for and will likely be more complex to plan for. Things like someone wanting to play hockey will have to include all of the equipment and the ice time and it could span many years. Plans for further education could require many extras besides the obvious school classes and books. Other costs could include rent, transportation, food, entertainment and loans. These goals can be in the form of a list with a monthly savings value or as YBP does it in a Family Profile and with a long term savings module.

Ensure you allocate savings for emergencies specifically, so if called upon to use them, your plan is not derailed and your saving depleted.

Analyze your Financial Goals

Goals are long-term so there is time to reassess them from time to time. Adjustments for the really long-term goals will surely be needed. Make sure that everyone in the family has been properly included. Build into your plan the eventuality of increasing savings if debt levels come down or are eliminated altogether. As you master this process, you can add more categories or improve existing ones - like adding a vacation, buying a nicer car, or, well, you get the idea!

Using a Budget

Using a budget is an excellent way to understand cash flow, savings and expenses. It can also keep track of the financial goals that are being saved for. A good budget will show how much is in your savings and what the savings are for. At YBP there is a special Long-Term Savings section and total in the Summary on the dashboard to help keep track of all savings and rectify it against bank accounts.

Investing

One of the financial planning key roles is to plan an investing strategy. The strategy should fit the knowledge level and risk level of the client. It is probably the toughest aspect of all financial planning. Remember, brokers are thought to know how to make money on stocks but the fact is they can't predict the future any better than a client. It is up to the client to decide what to invest in and to watch it over time. How often to watch it will depend on the risk level of the stock and when some cash will be needed.

Investing is the best way to increase savings at a reasonable rate. Investing is a long-term proposition. In the short term, the value of the investments will go up and down with the markets and the investment they funds are in.

see Investing for more details.

Putting Plan into Action

Now you must start saving better and spending wiser. This should provide increased savings. Make sure to protect the savings - don't spend them until it is the right time. Hide the savings away to ensure they remain as savings.

How to Achieve Financial Success

This is not an actual goal. It is the culmination of succeeding with actual goals. It is fulfilling the financial plan so to speak although it will mean something different to each person.

It can mean;

- spending and savings only what your income is

- not carrying any bad debt

- spending wisely throughout life

- saving properly for small and big-ticket items

- paying bills on time

- having an emergency fund

- agreeing on family expenses - not fighting over them

- saving for a sound retirement

- not having any debt upon entering retirement

Financial success doesn't mean having a luxury car and an expensive home in an upscale district. It would be nice but it is not a necessity. It is much more important to have peace of mind and a good standard of living.

Your Budget Plan is committed to providing long-term financial guidance so you can reach your goals.

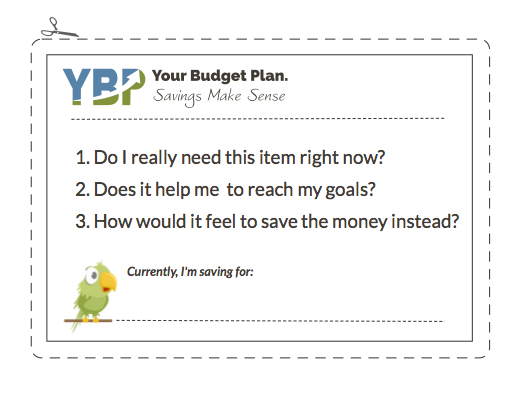

Have Your Budget Plan with you at all times - Download the 'Yes, I can stay on track!' - Wallet Reminder

(click to open a printable pdf)

You can purchase the "Your Budget Plan' system by clicking here