What makes our budgeting program different?

The Special features embedded in the program are.

The Quick Start Process:

We've made it easy to start your budget with an easy set-up app. Answer a few simple questions and tick a few boxes. If you're already a budgeter you'll find it intuitive and easy to set up. If you're inexperienced with budgeting we make it easy to learn quickly. Our program does all of the calculations such as income, expenses, and savings goals. Once you've put this information in you're on your way with a solid budget plan.

Next step, read the instructions page created to help get the best out of the program.

The new budget will look like this:

+++Put in the screenshot "Create a New Budget" from further down on the page+++

Once the new budget has been created by the system you will notice a series of sections. Each section will have some special features to help you budget better.

Target System:

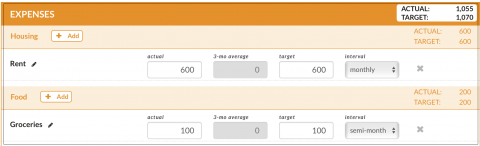

Building a Balanced Budget is key to successful budgeting. YBP uses a set of Target values to set up a balanced budget. The total target savings and expenses add up to your income. Staying near these targets creates a balanced budget.

Variable Income Adjustor:

Uneven cash flow causes many families to struggle with a budget. One month has more income and the next not enough. There is an optional Variable Income Adjustor calculator. The VIA system slowly builds up a cushion of cash in a separate account to use to even out cash flow.

Savings First Planners:

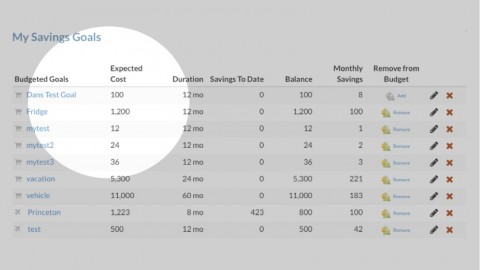

Is a method of saving funds. It simply means to put savings aside immediately. The website always talks about it and the Budget Program has a major category right after the Income. By being ahead of Spending, the site promotes savings and helps to hit your goals. Save the funds where you don't see or touch them.

YBP has a list of standard Savings Planners that calculate how much to save. They are also integrated such that they keep track of how much has been saved in total. Each one of the planners is very specific and detailed about what needs to be saved. There are planners for, traveling, vehicle purchases, weddings, and others. There is even a simple generic planner for basic savings and one that can be totally customized.

+++Put the screenshot from the bottom of the page for "My Savings Goals" here+++

+++ link to Savings First page +++

Debt Reduction:

We are serious about not creating bad debt and we are serious about paying off bad debt. To the extent that we have a Debt Tracker that shows up all the time. That alone reminds clients to not overspend. If seen enough it is bound to improve budgeting.

+++link to Debt page

Wise Spending:

The Budget Program uses targets to balance the budget. Once the monthly expenses are added to the budget it can be clearly seen if over-spending has occurred. Adjustments to the following month's spending can be made to get back on track.

+++ link to Wise Spending page+++

Flags: not yet set up so this section will have to be put aside for the time being.

+++show screenshot of a sample of a flagged issue +++

The Budget Program has a series of calculators that notify you via a flag that something is not right in the budget. If some totals are above a certain threshold, then a friendly reminder will tell you that some values are possibly wrong. Maybe, not enough funds were used to pay down debt or there weren’t enough savings put into a savings planner.

Family Profile:

+++put a screenshot of family profile here+++

By creating a list of important goals for the family a need to create good savings habits will be started. They don't all have to be started right away. In fact, only the main ones will be saved up for. These items and events become your Financial Savings Goals for your future.

Fill in the name of each family member and add in all of the things that are wanted for each person.

For example:

-if you have babies or very young children you can plan ahead by putting in some basic concepts and costs to make sure that the costs are accounted for. For example, you could have a baby and you could put down that you’ll need a new set of furniture and a gaming computer (or something like that) and put in a ballpark figure like $800. Then kids may go to preschool then elementary school then post-secondary school. This will create some savings so there are some funds when the time comes for such things.

-adults will require all sorts of things along the way including cars, furniture/electronic gadgets, and possibly lots of toys (sports and clubs). The list is vast

Just keep adding to the list as when something comes up so it won't be forgotten and check out the list periodically.

See your Progress in a separate Summary on the Dashboard.

+++need a screenshot of a summary from the Dashboard+++

Your personalized dashboard lets you review the progress of your budgeting goals at a glance, this is especially useful with family budgets where there are multiple goals running.

Using a budget helps control your funds. Using a budget with integrated calculators makes controlling your budget even easier.

Want to Reduce Stress?

Balance Your Budget and Grow Your Savings

Minimizing Financial Stress is an Effective Way to Improve Your Quality of Life.

put this higher up on the page as noted above

delete the smartphone picture from here but keep picture

put the following picture up in the section about Savings First