View Modes: the budget can be viewed in several modes.

Tip: Once you've determined your favourite view, set it as default (underneath budget title)

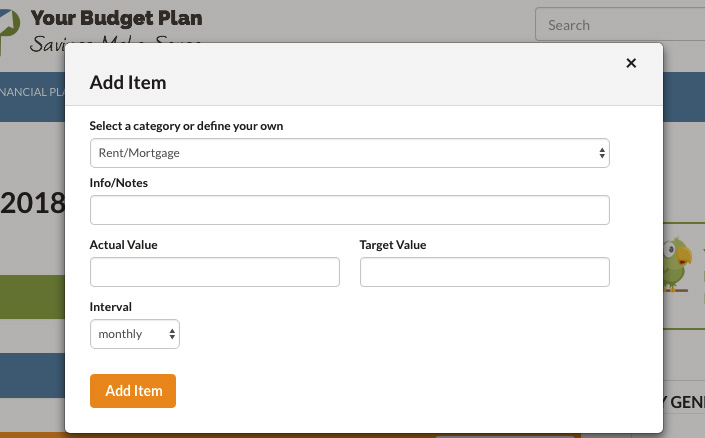

Adding an item click on a '+Add' icon and fill in the information.

Delete an item by clicking on the red X behind every item row.

Editing info in two ways (this varies slightly by view mode :

Gather all of your recent income, savings and expenses and keep them handy. It is best to find as many expenses as possible. If needed, estimate costs when bills aren't available. There are likely a few coffees or other snacks you don't have bills for. When first setting up a budget it is important to track expenses in order to get a handle on them, where excesses are and what needs to be remedied.

You might also want to use our feature to create a Family Profile. The Family Profile is a list of long term goals for each member of the family. Some of the goals will be monthly budget items, some will be long term savings goals. and some may not be feasible.

Making Contributions

YBP has been created so that your last contribution will be assumed in next month's budget, because most people usually put in the same amount from month to month. If you wish to change the calculated amount in one month, simply change the monthly amount in the respective savings goal. This will adjust the savings planner automatically.

Regular Monthly Contributions

The first contribution will be created automatically for you by creating the amount needed to save for the goal you create. If you don't wish to contribute the amount calculated simply edit the amount shown.

Special Contributions

Sometimes, we are in the position to add a lump sum to a goal that does not come from your usual salary. These amounts skew your budget so YBP keeps them separate. This helps to keep a balanced budget.

Withdrawals and Moving Funds

Sometimes, you may need to withdraw some funds to cover another goal or expense. In order to keep your savings planner balanced, you should WITHDRAW the amount from the chosen planner. You may CONTRIBUTE to another planner or if covering other expenses don't do anything more.

Payments for Expenses

In the course of the life time of a savings goal, you might have to pay for expenses even though the savings goal in itself is not finished. A typical case is a flight ticket that you will have to pay for before you actually go on the trip itself.

In the savings planner that you have dedicated to this trip, you have the option to enter a payment directly towards the expense item. Your flight expense will the reduced or paid off completely without affecting your budget. The new expense will be recorded and your savings will reflect the amount deducted.

Payments before the goal is finished are necessary so that your 'Savings to date' in the summary of that planner will match your bank account.

Recalculations

YBP calculates the preceeding features without disrupting your budget.

Pausing a Goal

You may wish to pause your savings for a month or more. YBP has a way to stop your savings then restart it at any time.

Finishing A Goal

When you are finishing up saving for a goal, there are three ways to complete the goal.

If a plan is paused it is not finished. To finish a 'paused' savings goal it must be reactivated then use one of the three methods above.

Targeted and Actual Amounts

People often ask, why it's necessary to have an actual amount and a target amount for each item in your budget. This is necessary, because actual expenses vary from month to month, whereas your target shows you what you are aiming for. The actual amounts will never match exactly the targeted amounts but your actual values should average close to your targeted values over a period of time. The targeted amounts should only be adjusted occasionally.

Allocation of funds

The purpose of allocation is to create a targeted balanced budget where the savings plus the expenses equal the income. It will take a few adjustments to get a balanced budget. YBP provides a note regarding your budget each time you save your budget.

Update Regularly

Updating regularly creates experience and transparency, which in turn creates knowledge. This is a prerequisite to get control over your finances. Getting control means that expenses stay on target and don't create debt, by knowing exactly what money you have available, you will be able to make more sensible decisions when it comes to expenditures. This in turn means that budgeting becomes easier and easier to do.

Follow Through

By following through with the plan and creating a balanced budget, you will be in control of your finances. This also means that you will achieve a higher level of satisfaction, success and peace of mind.

Eventually, as you grow more accustomed to your budgeting, you can transition to a less strict budgeting approach, the 'Expense-Control Budget' . This literally means that your expenses are under control.

Use Expense-Control Budgets

An Expense-Control Budget means that expenses are under control (expenses don't excede the Targeted amounts).

Therefore: no debt is created, expenses don't have to be highly monitored anymore, savings can easily be added to your Savings Goals.

Achieve the "Savings Budget"

Realistically, if your expenses are under control then you only need to pay attention to your savings. It's true. It is hard to do but it is possible. More to come on this very issue.

Your Budget Plan has two categories of income – 'Regular Income' that the budget is based on and ‘Extra Income’ that should not affect the budget because it is not consistent enough to be useful. Use the Extra Income categorie for all incomes that are one-time incomes, such as boni, a monetary gift, or a lottery win.

Savings Goals differ from Income and Expense items. They are more complex because according to your input, the goals grow dynamically and automatically every month. You also have the option to add extra contributions or make withdrawals. To add flexibility because life happens, your savings goals can also be paused, restarted or retired. Any savings can also be redistributed into other savings goals.

In general there are two different types of savings goals:

1. Preset Goals have a certain future event and time frame in mind (car, travel etc) and come with a set of expense categories so that you do not miss important costs. After you added all expenses and set a time frame, YBP will automatically determine the monthly amount of saving that will need to be budgeted. Any extra contributions or withdrawals will adjust this amount.

2. On-going Goals are goals that foster continuous saving. An example is $100/mo for your kid's education. As we don't need a concrete time frame here, you determine the monthly amount yourself.

Creating a Savings Goal Planner out of the Dashboard:

In your dashboard, you can also create Savings Goals. It works just like described above, however, since you're not coming directly out of the budget, you have a number of options:

You can track each individual bad debt you have

The program will add them up at the end of each time you work on the budget

If you have a bad debt that will take a few months to pay off then use the Debt Tracker

Once you’ve actually paid the bill click the ‘Paid’ slot.

The only way to pay off the debt is to pay more than the ‘Current Charges’. If you do the Total Remaining Debt will then be lower than the Balance Carried Forward which means the debt is going lower.