Frequently Asked Questions

Gather all of your recent income, savings and expenses and keep them handy. It is best to find as many expenses as possible. If needed, estimate costs when bills aren't available. There are likely a few coffees or other snacks you don't have bills for. When first setting up a budget it is important to track expenses in order to get a handle on them, where excesses are and what needs to be remedied.

You might also want to use our feature to create a Family Profile. The Family Profile is a list of long term goals for each member of the family. Some of the goals will be monthly budget items, some will be long term savings goals. and some may not be feasible.

- To start the program click on the calculator in the upper part of the website and your dashboard will pop up. this will change when Katja creates the startup page

- Click on 'create budget' and an empty budget form will popup. this will change when katja creates the startup page

View Modes: the budget can be viewed in several modes.

- Collapsed (major categories only listed - categories open on click)

- Semi-Collapsed (main budget categories are now visible)

- Quick Input Mode (all information is visible and can be edited/updated quickly)

Tip: Once you've determined your favourite view, set it as default (underneath budget title)

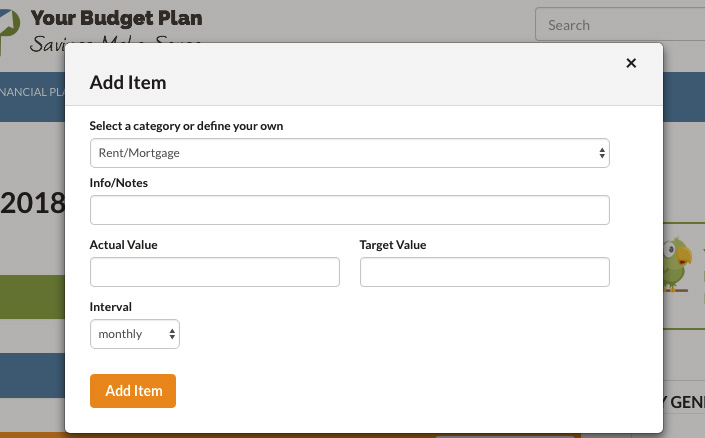

Adding an item click on a '+Add' icon and fill in the information.

Delete an item by clicking on the red X behind every item row.

Editing info in two ways (this varies slightly by view mode :

- Most number fields can be edited directly in the form.

- Titles and info/notes may need to use the little pencils (edit icons) besides each category. A popup box will appear and the information can be edited. In the Quick Input Mode the info field can be filled in right in the form.

- YBP has set up your budget program with common categories, such as 'Regular Income' and 'Housing' .

- To add a subcategory: use the '+Add' icon and a dropdown list will appear.

- Click on the subcategory desired; a popup will appear; fill-in the usual 4-5 information cells.

- Fill in a simple Category 'title'

- Fill in the 'actual value' for income, saved or spent/

- Fill in a reasonable 'target value'. This is the amount you will try to match in real life. When allocating amounts you should adjust the value until you get a balanced budget.

- Fill in any 'info/notes' that will remind you about your planning (e.g. - must go to less expensive restaurants)

- Choose the 'interval' the values are based on (e.g. monthly). The funds are then recalculated to a monthly format for consistency.

Savings Goals differ from Income and Expense items. They are more complex because according to your input, the goals grow dynamically and automatically every month. You also have the option to add extra contributions or make withdrawals. To add flexibility because life happens, your savings goals can also be paused, restarted or retired. Any savings can also be redistributed into other savings goals.

In general there are two different types of savings goals:

1. Preset Goals have a certain future event and time frame in mind (car, travel etc) and come with a set of expense categories so that you do not miss important costs. After you added all expenses and set a time frame, YBP will automatically determine the monthly amount of saving that will need to be budgeted. Any extra contributions or withdrawals will adjust this amount.

- Click on the '+Add' icon.

- Choose a preset planner from the dropdown list.

- Fill in a specific title, desired some info/notes, then the number of months to save (when do you plan to go to Hawaii?).

- In the Expense section, fill in the preset expenses, or click on the '+Add' icon and choose from the preset subcategories, then add the amounts.

- In the Contribution section you can view your savings. It holds all budgeted monthly contribution as well as other contributions that you might have made towards this goal (i.e. unexpected birthday cash). In order to make this tool work for you fullly, though, it is important to actually transfer the money from your checking account into a savings account.

2. On-going Goals are goals that foster continuous saving. An example is $100/mo for your kid's education. As we don't need a concrete time frame here, you determine the monthly amount yourself.

- Click on the '+Add' icon.

- Choose the on-going planner from the dropdown list.

- Fill in a specific title and if desired some info/notes and the monthly amount you'd like to save.

- Since this is an ongoing planner, there is no set Expense section.

- In the Contribution section you can view your savings. It holds all budgeted monthly contribution as well as other contributions that you might have made towards this goal (i.e. unexpected birthday cash). In order to make this tool work for you full, though, it is important to actually transfer the money from your checking account into a savings account.

Creating a Savings Goal Planner out of the Dashboard:

In your dashboard, you can also create Savings Goals. It works just like described above, however, since you're not coming directly out of the budget, you have a number of options:

- Budget the Savings Goal: 'Create Goal and Add to Budget' at the end of the planner - saves your goal directly into the budget.

- Save it as a draft for future use (but not budgeted). It will appear as a drafted goal in your dashboard only. To not budget a savings goal is useful if you want to compare certain savings options you might have.

Making Contributions

YBP has been created so that your last contribution will be assumed in next month's budget, because most people usually put in the same amount from month to month. If you wish to change the calculated amount in one month, simply change the monthly amount in the respective savings goal. This will adjust the savings planner automatically.

Regular Monthly Contributions

The first contribution will be created automatically for you by creating the amount needed to save for the goal you create. If you don't wish to contribute the amount calculated simply edit the amount shown.

Special Contributions

Sometimes, we are in the position to add a lump sum to a goal that does not come from your usual salary. These amounts skew your budget so YBP keeps them separate. This helps to keep a balanced budget.

- Use the Savings Goal in the Dashboard and click on the '+Add' icon.

- Fill in the information and add the contribution.

Withdrawals and Moving Funds

Sometimes, you may need to withdraw some funds to cover another goal or expense. In order to keep your savings planner balanced, you should WITHDRAW the amount from the chosen planner. You may CONTRIBUTE to another planner or if covering other expenses don't do anything more.

- Go to your Savings Goal

- Click "+Withdrawal" in your Contribution section.

- Enter the amount you would like to withdraw.

Payments for Expenses

In the course of the life time of a savings goal, you might have to pay for expenses even though the savings goal in itself is not finished. A typical case is a flight ticket that you will have to pay for before you actually go on the trip itself.

In the savings planner that you have dedicated to this trip, you have the option to enter a payment directly towards the expense item. Your flight expense will the reduced or paid off completely without affecting your budget. The new expense will be recorded and your savings will reflect the amount deducted.

Payments before the goal is finished are necessary so that your 'Savings to date' in the summary of that planner will match your bank account.

Recalculations

YBP calculates the preceeding features without disrupting your budget.

- Your contributions should match your savings accounts.

- The Contributions sections allows you to have a good overview of how your savings worked out over time.

- YBP constantly recalculates your savings target as you change information. YBP constantly up-dates your savings strategies.

Pausing a Goal

You may wish to pause your savings for a month or more. YBP has a way to stop your savings then restart it at any time.

- In the dashboard, under My Savings Goals, there is a column called Status. Click on the status icon and your goal will be paused for as long as you need it to be paused.

- When you wish to resume saving for your goal then reclick on the icon and your savings goal will resume where you left off, adding a contribution to your budget.

Finishing A Goal

When you are finishing up saving for a goal, there are three ways to complete the goal.

- You can use the 'payment/withdrawal' system to zero out your goal or

- You can save up the complete amount so that the program will show '0' and show 'finished.

- You can delete a goal using the delete icon. However if there are funds saved up they must be reallocated somewhere else or your Savings Account won't match your Savings Goal.

If a plan is paused it is not finished. To finish a 'paused' savings goal it must be reactivated then use one of the three methods above.

Targeted and Actual Amounts

People often ask, why it's necessary to have an actual amount and a target amount for each item in your budget. This is necessary, because actual expenses vary from month to month, whereas your target shows you what you are aiming for. The actual amounts will never match exactly the targeted amounts but your actual values should average close to your targeted values over a period of time. The targeted amounts should only be adjusted occasionally.

Allocation of funds

The purpose of allocation is to create a targeted balanced budget where the savings plus the expenses equal the income. It will take a few adjustments to get a balanced budget. YBP provides a note regarding your budget each time you save your budget.

Update Regularly

Updating regularly creates experience and transparency, which in turn creates knowledge. This is a prerequisite to get control over your finances. Getting control means that expenses stay on target and don't create debt, by knowing exactly what money you have available, you will be able to make more sensible decisions when it comes to expenditures. This in turn means that budgeting becomes easier and easier to do.

Follow Through

By following through with the plan and creating a balanced budget, you will be in control of your finances. This also means that you will achieve a higher level of satisfaction, success and peace of mind.

Eventually, as you grow more accustomed to your budgeting, you can transition to a less strict budgeting approach, the 'Expense-Control Budget' . This literally means that your expenses are under control.

Use Expense-Control Budgets

An Expense-Control Budget means that expenses are under control (expenses don't excede the Targeted amounts).

Therefore: no debt is created, expenses don't have to be highly monitored anymore, savings can easily be added to your Savings Goals.

Achieve the "Savings Budget"

Realistically, if your expenses are under control then you only need to pay attention to your savings. It's true. It is hard to do but it is possible. More to come on this very issue.

Your Budget Plan is set up for normal monthly payments. Most, if not all companies, now allow for automatic monthly payments via your bank. You may also check with your insurance company (or whatever company) to find out what other monthly options they have.

If you choose to save up monthly for an annual payment, the program has an Ongoing Savings Planner that allows you to save up monthly and make payments along the way (quarterly, semi-annually or annually).

how do you handle insurance expenses

the budget program is set up for normal monthly payments.

Most, if not all companies, now allow for automatic monthly payments via your bank. You may also check with your insurance company (or whatever company) to find out what other monthly options they have.

If you choose to save up monthly for an annual payment, the program has an Ongoing Savings Planner that allows you to save up monthly and make payments along the way (quarterly, semi-annually or annually).

YBP has a section called “Debt Repayment”. It is a calculator that helps reduce bad debt. It keeps track of how much bad debt you have, who it is owed to, and how much to repay each month. Bad debt is debt owed on top of regular debt. It is also debt that can’t be simply paid back in one or two months. Credit card debt is the prime example of bad debt. Using our calculator can help keep payments straight and debt understood. With every new monthly bill, you will determine your new current charges (all new charges that month plus interest that might occur for a balance carried forward) and a balance carried forward (all charges you were not able to pay off last month. The Debt Repayment Calculator will show clearly how much you have to pay to avoid a debt increase and lets you determine an amount that pays off your debt month by month.

I saved my budget last month but I noticed a mistake that I would like to change.

You can make editions to the last 2 budgets only. Go to your dashboard and click on the previous budget and it will pop-up. Make your edits and save the budget. If there is a value that needs editing in an older budget it may also be possible to adjust your latest budget by adding or subtracting the wrong amount in the latest budget to offset the amount.

I created a Savings Goal a few months ago and I’ve saved up some funds. I also got a bonus at work and would like to add that into the goal

- Open up the Savings section and click on the Savings Goal. The edit screen will pop-up.

- Open up the Contributions section. Click on the ‘Add’ icon to add contributions.

- Fill in the amount you want to add to the goal then click save. The amount will be added to your savings and the monthly amount to save will be recalculated.

I created a Savings Goal a few months ago and I’ve saved up some funds. I need some of those funds for an emergency

- If you haven't already, open up the Savings section in your budget and click on the Savings Goal.

- Open up the Contributions section. Click on the ‘Withdrawal’ icon.

- Fill in the amount you want to withdraw then click save. The amount saved will be reduced.

- You can then spend the amount on your emergency. The program will calculate your new monthly savings amount. You can also edit the Savings goal if need be now that the goal has been compromised.

created a Savings Goal but the amount is too much to save – how do I lower the monthly amount?

If you created a Savings Goal but later you notice that the amount is too much to save you can follow these steps to change your goal amount:

- You click on the savings goal which will bring up the edit screen for the savings goal.

- You have two ways to lower the amount.

- You can change the number of months to save (add more months) OR

- You can lower some of your expenses.

- Then save your work. A new monthly value will appear.

The budget has excellent planners set up to handle most of the regular big-ticket items.

In each case, simply scroll down to your blue savings section and click on ‘+ADD’

choose a Planner from the drop-down list.

- The targeted savings planners have 3 sections: the title block area, contributions and expenses

- Fill in the title, then fill out the expenses section.

- The sum of all expenses will be summed up to your savings goal amount.

- Save the Goal.

The savings goal page will show up indicating that the goal has been started and how much the monthly savings needs to be. It will also automatically add that amount into the budget once saved. If you wish to change the amount, click on the savings goal and change the amount.

If you don’t like the way this feature works please let us know by sending us a comment.

The new savings goal will appear in the your budget's savings sections.It will show up in your dashboard as well.

I don’t want to create complicated savings planners – just want some on-going savings for the future

The budget has two types of Savings Goals: one ongoing savings goal and a number of targeted savings planners to respond to big ticket items, such as travel or a car purchase.

To build up a safety cushion, you would choose an ongoing savings goal

Scroll down to your savings section in your budget and click on ‘+ADD’. Choose an Ongoing Goal.

This goal lets you pick your monthly target so that you budget in to put a certain amount 'away' each month. It's ongoing as it doesn't have a set end goal, like a trip to Paris would have.

what are the best things to do with extra income?

1st choice - use it to pay down any debt.

2nd choice - if you don't have any debt, you might want to consider adding it to your Emergency Fund.

3rd choice - If your emergency fund is already taken care of, you might want to add it to one of your savings goals.

4th choice - If all this is taken care of, go and spend the rest for a little treat :-).

how do you add in extra income without affecting the budget

the budget has two categories of income – Regular Income that the budget is based on and

Extra Income that shouldn’t affect the budget because it isn’t consistent enough to be useful.

Choose the Extra Income category and pick from the drop-down list. Fill in the notes and the actual value. For this category, the target is up to you and the interval is up to you.

Then Save.

I'll explain that later

You can track each individual bad debt you have

The program will add them up at the end of each time you work on the budget

If you have a bad debt that will take a few months to pay off then use the Debt Tracker

- Open up the app by clicking on the ‘+Add Debt Payment’.

- Choose a debt or create a debt

- Add in the due date

-

Add in the balance carried forward (total debt as of last statement or known debt) and the current charges

Example: you didn’t pay full rent and last month, you still owe $700. $700 is last statement and current charges are the month rent of $1,000. Fill in both the values in the two slots. - Fill in the ‘Payment this Month’

Once you’ve actually paid the bill click the ‘Paid’ slot.

The only way to pay off the debt is to pay more than the ‘Current Charges’. If you do the Total Remaining Debt will then be lower than the Balance Carried Forward which means the debt is going lower.

- open a dedicated account at your bank for the VIA

- there needs to be about 10% of your after taxes in the account

- if you have funds available put them in there or else save a bit each month until you have 10%

- then you can start using the app

- click on ‘+ Adjust Income’ then click on ‘Deposit to VIA Account and put in the amount box how much is in the VIA bank account, click ‘Adjust Income’ – now the app has some funds to work with

- when you do your budget fill in all of the after-tax income

- then click on ‘+ Adjust Income’ box and a drop down will appear

- the box has a line ‘Difference between Actual and Target Income with a value

- the value is the difference that will help you even out the monthly cash flow

- when you have lots of income you can add some to the account, when you have little income you can take from the account. You’ll have to learn by experience how much you can withdraw or deposit and it changes as the account grows.

- If the value is positive, deposit some of your income into the VIA account

- If the value is negative, withdraw some of the funds from the Via account to top up your monthly income

Your Budget Plan has two categories of income – 'Regular Income' that the budget is based on and ‘Extra Income’ that should not affect the budget because it is not consistent enough to be useful. Use the Extra Income categorie for all incomes that are one-time incomes, such as boni, a monetary gift, or a lottery win.